Today

Steven Joblike started a poll in your post “How to be a good trader in 2025”

Just now

Steven Joblike started a poll in your post “How to be a good trader in 2025”

Just now

We are proud to have top class clients and customers,which motivates us to work more on projects.

States

Panel

BCP

Years

PPI

Every business is unique. Hoogmatic customizes its services to fit your industry, size, and specific needs, ensuring you get the most relevant support.

Backed by industry veterans and certified professionals, Hoogmatic ensures your business decisions are supported by in-depth knowledge and insight.

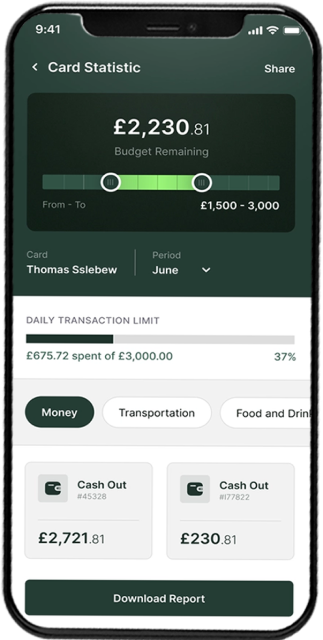

We're thrilled to introduce a powerful new feature on the Connector portal – the ability to check CIBIL scores of individuals! Now, you can easily access crucial financial information with just a few clicks.

Create a simulated CIBIL report without the need for OTP verification.

Instantly generate and download the CIBIL report in PDF format.

Share instantly the generated pdf file of CIBIL.

Take charge of the number of CIBIL generated at your fingertips.

The Connector Portal gains enhanced capability with instant PAN Card issuance for new applications or corrections.

Effortlessly access your PAN account with a seamless login experience.

Stay informed with instant, real-time updates.

Choose between obtaining a new PAN or making corrections to an existing one through the Connector Portal.

Receive an instant refund if your PAN application is not completed within 48 hours.

Happy Clients

Hoogmatic proudly unveils its Android app, Clink—your all-in-one solution for seamless management and on-the-go accessibility.

Log in quickly and securely—your account is just a tap away, no delays or fuss.

Get real-time alerts and updates that keep you connected and in control—wherever business takes you.

Stay on the latest version with seamless, background updates—no interruptions, no complications.

Handle your customer data and interactions effortlessly, with full CRM functionality right in your pocket.

Our mission is to make web design easy, so you can focus on building your brand.

Our team comprises seasoned professionals dedicated to delivering top-notch services. With years of experience under our belt, we bring a wealth of knowledge to the table

We understand that one size doesn't fit all. That's why we offer customized solutions to meet your specific needs. Your success is our priority, and we work closely with you to achieve it.

We stay ahead of the curve by incorporating the latest technologies into our services. This ensures that you benefit from innovative solutions that give you a competitive edge.

Your satisfaction is at the core of what we do. We value open communication and transparency, fostering a strong partnership to drive mutual success.

Don't just take our word for it—our track record speaks for itself. We have a history of delivering results and helping clients reach their goals.

When you choose our services, you can count on us. We prioritize reliability and consistency, providing you with peace of mind as you focus on what you do best.

As a Hoogmatic's Digital Service Point franchisee, you'll have the opportunity to tap into multiple revenue streams within the finance and taxation industry.

We understand that every entrepreneur has unique needs and preferences. That's why we offer a flexible business model that can be tailored to suit your individual goals.

Get Everything Done in Just 3 Steps

Create your free Hoogmatic account and log in to get started.

Fill in your basic details as prompted—quick, simple, and secure.

Select the subscription plan that fits your needs and goals best.

Hoogmatic comes with most affordable pricing range. Choose from a range of flexible plans tailored to suit your business's growth needs.

Familiarize yourself with the payment options provided below.

Validity 1 Year

₹ 5,999/-

Validity Life Time

₹ 17,700/-

Validity Life Time

We have shared some of the most frequently asked questions to help you out.